Housing Market Trends and Predictions for 2025

As of April, the average mortgage rate stands at 7.1%. Meanwhile, the median home price in the U.S. has increased by 2.5% year-over-year, now reaching $410,700. However, there’s a glimmer of hope for prospective buyers: in 2025, experts predict that affordability may improve slightly as mortgage rates are expected to ease, while home price growth is anticipated to slow.

Nevertheless, significant economic uncertainties remain. If current inflation trends persist and tariffs affect the broader economy, these forecasts could change. For buyers, the combination of escalating home prices and mortgage rates over the past few years has resulted in a difficult market environment, leaving many potential buyers anxious to take advantage of any improving conditions.

U.S. Housing Market Forecast 2025: What It Means for Fire Door Demand

At YK fire rated door manufacturer, our mission goes beyond delivering high-performance metal fire door solutions—we also track macroeconomic trends that shape construction, development, and safety compliance across the United States. After months of research and data aggregation, we’ve developed this comprehensive insight into the 2025 U.S. real estate market, with a special focus on how evolving housing dynamics may influence demand for fire doors and frames, especially in the commercial metal doors sector.

Decelerating Price Growth Amid Economic Caution

In February 2025, U.S. home prices posted a 3.9% year-over-year increase, marginally below the 4.1% growth recorded in January, according to the S&P CoreLogic Case-Shiller Home Price Index. This figure reflects transactions from December 2024 through February 2025—a period characterized by expanding inventory and slightly softening mortgage rates.

Although housing prices continue their upward trend, the deceleration is notable across the US real estate market. Analysts anticipate further moderation as American households grapple with inflation and financial uncertainty. Unfortunately, slower appreciation doesn’t necessarily equate to greater affordability. Rising insurance, taxes, and interest payments are still pricing many would-be buyers out of the market.

Nevertheless, regional variation within the US real estate market brings glimmers of opportunity. In the Northeast, constrained inventory and stronger wage growth have propelled home prices higher. Meanwhile, markets in the West and Southeast are stabilizing, supported by increased housing stock and moderated buyer activity.

Is a Housing Market Crash on the Horizon in 2025?

Concerns about an imminent crash are understandable, especially as prices remain near all-time highs. But most real estate professionals agree: a full-scale correction like 2008 is unlikely. Limited housing supply remains a powerful stabilizing force in the US real estate market.

More importantly, today’s homeowners are generally better positioned than during the last crisis. With increased home equity and a record number of mortgage-free owners, the threat of widespread foreclosures is minimal.

At YK, we observe these trends not just as market analysts, but as a commercial fire door manufacturer serving sectors directly affected by housing performance. Lower volatility in the residential sector often translates into steadier commercial demand for steel fire resistance doors and industrial metal doors, particularly in mixed-use developments and multi-family complexes where building codes enforce strict fire safety standards.

Monthly Mortgage Payments: Then vs. Now

In March 2025, the median U.S. home sold for approximately $361,000. Buyers securing a 30-year fixed loan at 6.65%—and putting 20% down—are now paying around $1,853 in monthly principal and interest. That’s only $9 more than in 2024, yet this minor difference accumulates to over $2,100 across the loan’s lifetime.

This marginal shift may seem trivial, but in an era of compressed budgets, it reinforces how every financial decision—including the integration of commercial metal door with glass or stainless steel fire door options in new construction—must be both strategic and code-compliant.

Housing Market Recovery Outlook: What Must Improve

For a genuine housing market recovery to emerge, two major variables must shift.

1. Inventory Levels Must Rise

A higher inventory of homes for sale would reduce price pressure, potentially restoring balance in overheated markets. This would also stimulate complementary industries, including commercial renovation, fire safety upgrades, and fire doors commercial installations for buildings converting from residential to mixed-use.

2. Mortgage Rates Must Decline

Rates have remained above 6.5% for over six months. If the Federal Reserve introduces further interest rate cuts, we could see a downward adjustment. Still, even a rapid rate drop could lead to sudden demand spikes—once again shrinking available inventory.

The most sustainable scenario is a gradual return to 4.5%–5.0% rates, which could boost construction starts. As new projects ramp up, demand rises not only for framing and insulation but also for metal fire door systems, fire-rated hardware, and commercial metal doors that comply with UL and NFPA codes.

Key Factors Influencing Housing Market Trends in 2025

Several macroeconomic factors contribute to shaping the future of the housing market. Among these, inflation, mortgage rates, and housing supply will play a pivotal role in shaping trends.

As the U.S. real estate market gradually rebounds—especially in the multifamily and commercial building sectors—demand for UL-certified fire doors is steadily increasing. To meet stringent fire safety codes and enhance property protection standards, more developers and construction contractors are prioritizing steel fire doors and wood fire doors that comply with UL standards. In both new construction and renovation projects, installing fire-rated door systems that meet NFPA requirements has become the industry norm. This not only improves the building’s overall fire resistance but also helps ensure smooth fire inspection approvals and reduces potential fire risks. As a result, UL fire doors are seeing strong growth in the U.S. real estate sector, particularly in a market that values compliance and insurance-friendly building solutions.

Economic Climate and Federal Reserve Policy

In response to soaring inflation rates in 2022, the Federal Reserve raised interest rates aggressively to rein in price growth. This pushed mortgage rates higher, significantly influencing buying decisions. Fortunately, inflation has started to decelerate, with the consumer price index rising by only 2.4% year-over-year in March—a marked decline from the 9.1% peak in June 2022. As a result, the Fed began reducing rates last year, with further cuts expected in late 2023.

However, the Fed is holding the rates steady for now, as the global trade environment, particularly the impact of tariffs, may have a counterbalancing effect. Tariffs could raise costs and slow economic growth, potentially influencing mortgage rates and, by extension, the US real estate market, where home prices and financing conditions remain highly sensitive to monetary policy.

Mortgage Rates and Their Impact

The connection between mortgage rates and home prices is profound. With mortgage rates remaining high, many would-be homebuyers have been sidelined, and sellers hesitant to part with properties that are financed with lower mortgage rates. The restricted inventory has contributed to a persistent upward pressure on home prices, despite the higher borrowing costs.

Looking ahead, experts predict that by the end of 2025, mortgage rates could fall to the low-to-mid 6% range. However, this will largely depend on the trajectory of inflation. If inflation resurges, rates may climb again, potentially cooling the demand for housing.

Housing Demand and Supply

Housing demand is a fundamental driver of home prices. When more buyers are competing for fewer homes, prices tend to rise. Currently, high mortgage rates have kept demand subdued. However, as rates moderate in the coming year, the demand may surge, which could push home prices higher, particularly in areas with limited housing inventory.

A recent analysis by Zillow highlighted a significant shortfall in housing inventory: the U.S. is currently 4.5 million homes short of a healthy supply. This has driven both home prices and rent prices up. However, a promising trend is that inventory levels have been improving. In April, inventory was up 30% year-over-year, marking the 18th consecutive month of growth in housing supply.

Real Estate Forecasts for 2025

Experts predict that, despite higher rates in the near-term, mortgage rates will ease slightly, and price growth will moderate in 2025. This will offer some much-needed relief to potential homebuyers, though the overall affordability challenge will remain.

Recent Sales Performance and Its Implications for Fire-Rated Building Products

At YK fire rated door manufacturer, we understand that macroeconomic indicators—such as home pricing trends—are early signals for downstream demand in construction and commercial outfitting. As the US real estate market continues to recalibrate, the demand for steel fire resistance doors, fire doors commercial, and commercial metal doors remains tightly linked to housing activity and developer sentiment.

Home Price Gap Between New and Existing Construction Narrowing

Based on joint data from the U.S. Census Bureau, HUD, and NAR, the price spread between new and existing homes has seen notable fluctuations in recent months:

| Month | New Home Median Sale Price | Existing-Home Median Sale Price | Price Difference | % Difference |

|---|---|---|---|---|

| Dec 2024 | $423,000 | $403,700 | +$19,200 | +4.7% |

| Jan 2025 | $431,400 | $393,400 | +$38,000 | +9.2% |

| Feb 2025 | $411,500 | $396,800 | +$14,700 | +3.6% |

| Mar 2025 | $403,600 | $403,700 | -$100 | -0.02% |

In March, for the first time in over a year, the price gap effectively disappeared. This convergence may affect construction priorities, prompting developers to weigh the cost of new builds more critically—especially when factoring in compliance products like metal fire doors, stainless steel fire doors, or commercial metal doors with glass.

Pending Sales Rebound Signals Near-Term Movement

The Pending Home Sales Index, a key leading indicator, rose 6.1% in March. This uptick suggests that the slight easing in mortgage rates helped reignite interest among prospective buyers. Still, overall activity remains subdued: year-over-year pending transactions are down 0.6%.

Consumer hesitation stems from persistently high borrowing costs and economic instability. As Joel Berner of Realtor.com notes, concerns over employment and global trade volatility have shaken confidence.

For commercial and industrial sectors—especially those involved in multi-unit residential or light commercial construction—these sales signals translate into cautious progress. Yet, as planning cycles catch up, we anticipate sustained demand for industrial metal doors, fire doors and frames, and security-enhancing access solutions in new or converted developments.

Spring Market Outlook: Can Buyers Expect Relief?

Despite modest signs of easing, affordability challenges remain steep. According to Zillow, average mortgage payments have jumped more than 108% since the pandemic, now accounting for 35.3% of median household income—well above the recommended 28%.

In a climate where every budget line matters, developers and property managers are increasingly prioritizing products that deliver both code compliance and lifecycle value. At YK, we’re seeing a rise in inquiries for metal fire door assemblies that meet UL 10C and NFPA 80 standards while also delivering architectural quality and energy efficiency.

As Robert Frick of Navy Federal Credit Union observes, ongoing inflationary pressure—aggravated by tariffs—may lead to renewed price acceleration. If stagflation materializes, construction budgets could be further squeezed, potentially boosting the appeal of fire-rated solutions with low maintenance and long-term performance metrics.

Housing Inventory Remains Constrained—Delaying Price Correction

Though inventory is rising modestly, total for-sale housing stock is still far below historical norms. Many existing homeowners, locked into sub-4% mortgages, are unwilling to sell. This “rate lock-in” effect continues to tighten supply, especially in major metro markets.

Rick Sharga of CJ Patrick Company expects no meaningful inventory increase until rates return to the 5% range. Until then, demand will likely continue to exceed supply—sustaining elevated home prices.

In response, federal policy shifts are underway. The current administration has signaled support for deregulation and land reallocation to stimulate development. However, simultaneously, tariffs and immigration restrictions are pushing construction input costs higher. These pressures reverberate across the value chain—from framing materials to commercial metal doors and fire-rated assemblies for both residential and mixed-use structures.

At YK fire rated door manufacturer, we’ve adapted by streamlining our sourcing, enhancing manufacturing efficiency, and expanding our Miami metal doors distribution capabilities to serve builders facing tight timelines and tighter margins.

Home Price Predictions

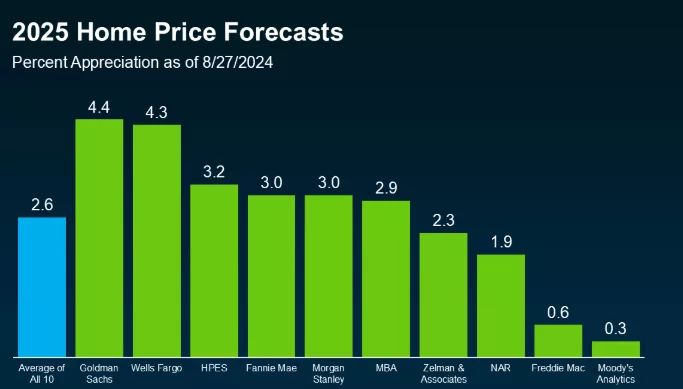

Looking at the broader outlook for home prices, analysts expect growth to continue, albeit at a much slower pace. The Mortgage Bankers Association projects a modest 1.3% increase in home prices in 2025, followed by 0.3% in 2026. In contrast, Fannie Mae forecasts a 4.1% rise in home prices in 2025, with slower growth to 2% in 2026. The National Association of Realtors expects a 3% increase in home prices for 2025, with a 4% rise in 2026.

Home Price Outlook and Market Adjustments

In the coming years, home prices are unlikely to experience drastic declines. However, as the market stabilizes, home affordability should improve slightly due to a decrease in mortgage rates and a rise in housing inventory. Some regions may even experience minor price decreases, offering opportunities for buyers.

Currently, we’re still recovering from the post-pandemic housing boom, where prices escalated rapidly. Looking ahead, homebuyers can expect more moderate price increases as the market continues to normalize.

According to the latest data from the Census Bureau and the Department of Housing and Urban Development, the median home price in Q1 2025 is expected to reach $416,900, reflecting a 2.32% decline from 2024. This is a sign that price acceleration is slowing.

Housing Inventory Forecast: A key factor in market improvement is the need for increased housing supply. If mortgage rates decline further, more home sellers are expected to enter the market, adding to the number of available homes. A critical factor in solving the affordability issue will be the balance between supply and demand, with a healthier inventory helping stabilize home prices.

Regarding new home construction, Fannie Mae expects a slight drop in housing starts in 2025, with increased growth anticipated by 2026. Similarly, the Mortgage Bankers Association (MBA) forecasts flat construction activity in 2025, followed by a slight uptick in 2026.

Long-Term US real estate market Forecast: 2025 and Beyond

Given the impact of macroeconomic conditions, forecasting the housing market five years into the future is difficult. However, some trends seem clear:

- Chronic supply shortages will likely continue, although addressing this issue may gain more focus as local governments take steps to improve housing stock.

- Mortgage rates are expected to return to more typical levels, encouraging more sellers to enter the market, which should improve housing inventory.

- Housing Construction Outlook: Builder Confidence Wavers Amid Cost Pressures

At YK fire rated door manufacturer, we closely monitor builder sentiment and construction activity—vital leading indicators for demand in steel fire resistance doors, metal fire doors, and commercial door systems. The latest housing outlook offers a mixed picture, with modest gains in confidence overshadowed by material cost pressures, slowing starts, and rising foreclosure activity.

Builder Sentiment Inches Up But Remains in Negative Territory

According to the April NAHB/Wells Fargo Housing Market Index (HMI), builder confidence rose marginally from 39 to 40. However, the index remains well below the threshold of 50, which would indicate a positive construction outlook.

The last time sentiment exceeded 50 was in April 2024—before escalating tariffs, labor shortages, and policy uncertainty clouded the industry.

“Builders are facing mounting challenges,” noted Robert Dietz, NAHB Chief Economist. “Tariff-driven costs are now a top concern.” In fact, the average per-home cost impact from tariffs has surged to $10,900 in April, up from $9,200 in March.

For fire-rated steel doors, these material cost escalations directly affect production margins and buyer pricing sensitivity. At YK, we’ve responded by optimizing our supply chain and offering customizable fire door solutions that balance compliance, durability, and value—especially critical as projects seek to cut excess spend.

Home Starts Decline—Signaling a Cooling Market

The U.S. Census Bureau and HUD report shows single-family housing starts fell sharply in March, down 14.2% month-over-month and 9.7% year-over-year. While completions rose modestly (up 0.9% MoM and 9.6% YoY), the construction slowdown appears to be taking hold.

“Headwinds are increasing for homebuilders,” observed economist Robert Frick. “The environment for aggressive new development is deteriorating.”

This shift presents both risks and opportunities for the commercial sector. Builders and developers are now more selective—choosing industrial metal doors, fire doors and frames, and other high-performing components that offer long-term reliability and compliance with NFPA 80, UL 10B/10C, and local fire codes.

Foreclosure Trends Raise Concerns—But Equity Offers Stability

In Q1 2025, foreclosure starts rose 14% quarter-over-quarter and 2% year-over-year, according to ATTOM. REOs (bank-owned properties) also jumped 8% compared to Q4 2024, though they remained 4% lower than a year prior.

Analysts note that while activity is still far below post-2008 crisis levels, the trend warrants close monitoring. Economic instability and high monthly mortgage payments are beginning to pressure some homeowners—especially in regions with limited refinancing options.

Yet, widespread distress seems unlikely in the near term. As Rick Sharga explains, “Record levels of home equity are acting as a buffer.” In fact, homeowner equity grew by $2.8 trillion in 2024, pushing the total to over $34.7 trillion—with nearly 47% of U.S. mortgages now classified as “equity-rich.”

This equity cushion means even distressed homeowners often have options to avoid foreclosure, including selling their homes before auctions. For construction and remodeling professionals, this translates into continued retrofit and renovation activity—further fueling demand for fire-rated steel doors, retrofit commercial fire doors, and code-compliant exit systems.

Strategic Outlook for Building Product Manufacturers

Given the continued volatility, smart builders and architects are placing a premium on durability, code compliance, and value-engineered components. At YK fire rated door manufacturer, our expertise in metal fire doors, commercial fire doors, and steel fire resistance doors positions us to support developers navigating tighter budgets and evolving regulatory standards.

As the construction cycle resets, we’re expanding our Miami metal doors distribution network and developing new fire-rated commercial door systems that blend safety, style, and performance—without inflating project costs.

Is Now the Right Time to Buy a Home?

There’s significant pessimism surrounding homeownership, with many potential buyers waiting for “the right time.” While current market conditions may seem tough, it’s important to understand that opportunities for homeownership still exist. First-time homebuyers can take advantage of down payment assistance programs, which can reduce the upfront costs of purchasing a home.

Mortgage products now allow buyers to secure a home with as little as 1% down, making homeownership more accessible than ever. Programs for first-time buyers have made purchasing homes more feasible, even in challenging economic conditions.

What Home Sellers Need to Know

For home sellers, the market has been largely characterized by low inventory, meaning fewer homes are being listed. However, as mortgage rates decrease, more sellers will likely decide to list their properties, knowing that they will face less competition and can still sell at competitive prices.

For those contemplating selling their homes, 2025 could be an ideal time to do so. As mortgage rates ease and demand picks up, sellers may have a better chance of receiving full offers or even higher-than-expected prices.

The Impact of the “Silver Tsunami” on Housing Prices

Looking ahead, the “Silver Tsunami” — the mass wave of baby boomers aging out of their homes — is expected to have significant impacts on housing prices. Many baby boomers are holding on to properties, but as they age or move into retirement homes, an increasing number of these homes will be returned to the market, contributing to the housing supply.

For first-time buyers, this shift could be a game-changer. With more homes available, there will likely be less competition, and prices may rise at a more moderate pace, providing a better entry point into homeownership. However, the full effect of this demographic shift will likely take several years to materialize.

How to Prepare for Buying a Home in 2025: 5 Essential Tips

Whether you’re preparing for homeownership in 2025 or later, here are some strategies to help you get ready:

1. Get Your Finances in Order

Improving your credit score is one of the most effective ways to secure the best possible mortgage rate in the current US real estate market. Reducing your credit card balances and lowering your debt-to-income ratio will make you a more attractive candidate to lenders. Focus on paying down cards with the highest interest rates first to achieve the best results.

2. Explore Affordable Mortgages and Assistance Programs

For first-time homebuyers navigating the US real estate market in 2025, utilizing specialized mortgages and down payment assistance programs will be crucial. FHA, VA, and USDA loans offer options with low or even no down payment. Be sure to research lenders that provide these programs, such as Rocket Mortgage and Bank of America, which also offer down payment grants.

3. Time Your Purchase

Choosing the best time to buy depends on your priorities. Mortgage rates are expected to gradually decline in 2025, which could improve affordability in the US real estate market. Inventory levels are also projected to rise, giving buyers more options. Off-season months like fall and winter may offer less competition, although available listings might be fewer.

4. Don’t Rush the Process

Buying a home is likely the largest financial decision you’ll make, especially in today’s competitive US real estate market. Take the time to evaluate your financial readiness thoroughly. If you need extra time to save or improve your credit score, postponing your purchase could help you enter the market more confidently.

5. Build Your Savings

Whether you’re saving for a down payment or emergency fund, having additional funds set aside will give you a competitive edge. Larger down payments typically result in better mortgage rates, and homes with substantial down payments are more appealing to sellers. Additionally, ensure that you have money available for unexpected expenses, which can be common during your first year of homeownership.

As we move through 2025, the US real estate market continues to evolve under the weight of high mortgage rates, limited inventory, and shifting economic signals. While timing the market may seem tempting, most experts agree: the “right time” to buy or sell is highly individual—rooted more in personal readiness than in macro predictions.

Whether you’re purchasing your first home or planning a large-scale construction project, long-term value, financial preparation, and informed decision-making remain the keys to success.

For builders, developers, and architects operating in today’s complex landscape, selecting the right partners and materials is more critical than ever. At YK fire rated door manufacturer, we support construction and renovation professionals with high-performance steel fire doors, custom fire-rated doors, and industrial metal fire doors that meet today’s stringent safety standards without sacrificing design or durability.

As affordability challenges persist and code compliance becomes more demanding, YK remains committed to helping you build smarter—whether you’re upgrading a multi-family complex, outfitting commercial fire door systems, or enhancing fire protection in institutional buildings.

Explore our fire door solutions today and discover why YK is the trusted name in performance, protection, and precision manufacturing.

Pingback: Fire Resistant Door Market Trends and Investment Insights - YK | Fire Doors | Fire Windows | Fire Shutters